Most Powerful Women in Technology

Top 100 Women in Fintech

Democratizing the Private Markets

Mother of Unicorns

Democratizing the Private Markets

Democratization of the Private Markets, Including Retail Investors in Private Market Investment Opportunities is Key to Shrinking the Wealth Divide and Income Inequality, While Increasing Capital Formation, Innovation, US Leadership & Life Quality

Democratization of the Private Markets: By Mona DeFrawi & Lincoln Ross, with gratitude for contributions by Radivision’s Advisory Board Members, Rena Silverman, and Peter Bass

Democratization of the Private Markets: The GameStop short squeeze kicked off 2021 with the democratization of the public markets and woke us up to the fact that small investors, organized together, can generate a force capable of delivering billions in losses for sophisticated fund managers, and millions in gains for themselves and their target’s market capitalization. The day when shares soared 1,700 percent as small investors employed a classic Wall Street tactic fueled by social media, marked a historic moment for all watching, regardless of sectors or interests. We also witnessed many of these unaccredited investors lose their life savings in the process.

Up next is the Democratization of the Private Markets. Are we ready?

The U.S. Securities and Exchange Commission (SEC) has a three-part mission: to protect investors; to maintain fair, orderly, and efficient markets; and to facilitate capital formation. The financial markets infrastructure changes of the late nineties – like tectonic plates shifting – transformed many formerly public market investments into private market deals quickly and almost invisibly while masked by the great activity of the “Internet Bubble”. But the laws governing access to these newly private investments have taken much longer to adjust.

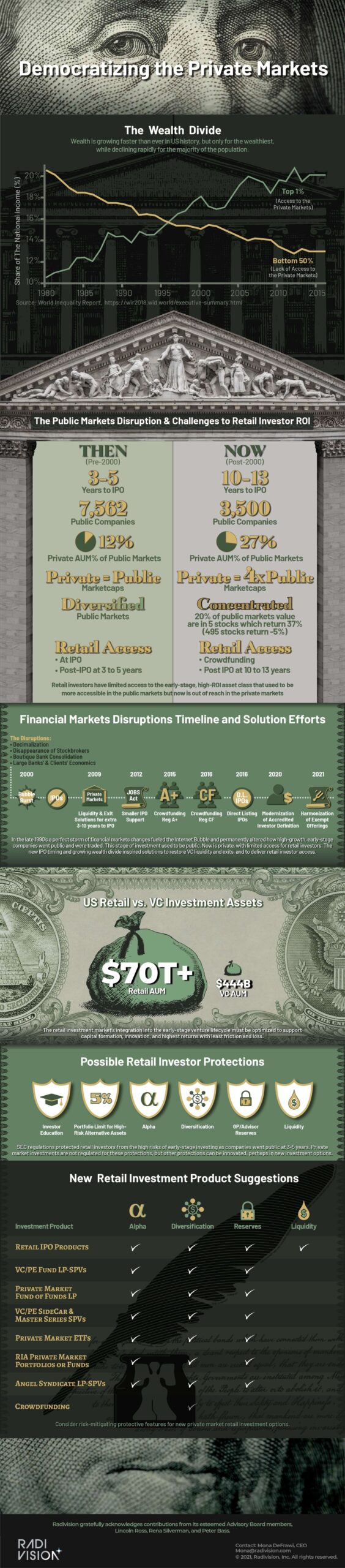

Previously, retail investors used to comprise nearly half of public, venture-backed companies’ shareholder base, and had access to Initial Public Offerings (IPO)s, which occurred at three to five years after founding. SEC unaccredited investor protections, forbidding higher-risk private markets investing, have left retail investors without access to early-stage venture-backed investments – one of the highest performing assets for the past two decades. The result is a growing wealth divide1 catalyzed by the political polarity and the chaos historically experienced as economic paradigms shift. Aware of the dangers of these trends, and committed to protecting investors and capital formation, the SEC has focused attention over the past decade to leveling the playing field for retail investors who have been left “increasingly on the outside looking in.”2

And so, we have an opportunity now. Recent SEC regulations are accelerating private markets access for the $67 trillion of US retail investment assets.3 Soon, this massive asset pool will have the power to shift the venture industry, just as its loss of access in the late nineties contributed to the IPO disruption that permanently altered venture exits, liquidity, and volatility.4 Just five percent of US retail investment assets, or $3.4 trillion, could unleash a virtual tsunami of new funds into our industry, which measured at only $444 billion total assets under management, with $150 billion invested in 2020.5

Anticipated and supported, this new private-market activity can propel an era of unprecedented US economic growth, innovation and opportunity while shrinking the wealth divide. If we consciously help direct retail-investment funds into sustainable capital formation through new investment products that support healthy exits, liquidity, and valuations, we can avoid passively repeating inflationary bubble and burst scenarios that wreak havoc on the venture ecosystem and the US economy for years.

The SEC has devoted much effort over the past decade and introduced several regulatory solutions to correct the public market’s disruption, to support capital formation, and to re-enfranchise retail investors. From the Jumpstart Our Business Startups (JOBS) Act of 2012, to Regulation A+ of 2015 and Regulation Crowdfunding of 2016, to the recently amended Accredited Investor definition of December 2020, to the simplification and harmonization of securities and exempt offering requirements that went into effect March 15, 2021. Next in discussion, is allowing retail investors to access private-market investments for their IRAs and 401Ks.

Today, retail investors can invest in the private markets primarily via crowdfunding, which as the nascent industry currently operates, ostensibly offers higher risks with undiversified, 100% exposure to a 90% failure rate industry, without the benefit of advisors, usually without powerful venture firm support, and possibly with additional selection bias. Conscious evolution of future retail private market investments should consider additional built-in consumer protections to manage risk, and new, structured financial products designed to improve protections, returns, and success – similar to those available to sophisticated investors. Below are five suggested measures that can be help decrease retail investor risk:

- Education – Investors must understand the complex, financially sophisticated private markets and their risks, similar to testing for a driver’s license to ensure the complex rules of the road are understood before getting behind the wheel. The huge losses suffered by most of the GameStop retail investors might have been mitigated with more education prior to investing.

- Limit to 5% or less of total portfolio – Institutional investors usually limit high-risk alternative assets, such as venture capital, to 5 percent or less of their overall portfolio. Consumer investors can be limited to the same protective measure.

- Alpha – Professional, experienced management or advising can improve return potential, and has a fiduciary duty to protect the managed product and its investors. Retail investors should be able to benefit from managed funds, angel syndicates, and other managed investment opportunities that more sophisticated investors have access to today.

- Diversification – Investing in funds or products offering a diversified portfolio better balances risk vs. individual crowdfunding deal investing.

- Reserve Requirements – Requiring new fund and product managers to have reserves invested delivers “skin in the game” protections for the investors. The appropriate level of reserves should be analyzed and discussed.

Part of the current challenge to balance opportunity for retail investors is that IPOs now linger too long and cost too much. What used to take a few years, now spans twice as long. Today, retail investors must now wait 10 to 13 years for companies to IPO, after much of the early-stage return potential is no longer available in these mature, later-stage companies. Stockbrokers, market makers, and financial analysts provided important retail investor “sales and marketing” infrastructure, which disappeared with changing economics and Sarbanes-Oxley restrictions. And large banks and hedge funds significant heft, permanently altered the execution and timing of IPOs. Today, retail investors have only around 3,500 public companies to consider for investment compared to a peak of 7,562 in 1998. The Wilshire 5000 index which was designed to measure the performance of the total US equity market has not had 5000 constituents since 2005.6

Yet, looking back over this same time period private companies have outperformed public companies with much less risk. Venture capital has been the highest performing asset class in most of the years of the past decade. Cambridge Research analysis shows the top quartile of VC funds have an average annual return ranging from 15 percent to 27 percent over the past ten years, compared to an average of 9.9 percent S&P 500 return per year for each of those ten years.7 The impact of great companies staying private for longer, or indefinitely, has significantly disadvantaged retail investors and their advisors looking for diversification, better risk-adjusted returns and values-based investment options. Providing retail investor access to private markets diversifies their risk while contributing to market stability and reducing risk concentration.

Index investing, theoretically a tool for retail investors to access a broad exposure to public companies, is suffering from the limited number of public companies. A stark example of limited diversification was seen this summer as public markets emerged from the pandemic correction when five stocks were up 37 percent while the other 495 names in the S&P were down five percent, leaving index investors with a 2 percent return.8

Another dangerous result of piles of retail investor cash chasing too few investment options is the Reddit driven stock craze that has created single stock bubbles leaving many retail investors with outsized losses. A recent Reddit user who had GameStop losses of over $400,000 posted that he has “been poor for too long” and is “looking to strike it big”. 9

New investors from Millennial and GenZ generations are increasingly looking to align their investments with their values and are often disappointed with the lack of available choices. New investment products like cryptocurrency (crypto), decentralized finance (DeFI), Non-Fungible Tokens (NFTs), even sneaker exchanges have catapulted to headlines, but one of the most consistent and growing trends for these generations is the importance of investing aligned to their Environmental, Social, and Corporate Governance (ESG) value system. Professionally managed assets with an ESG preference have grown from less than two percent of assets in 1995 to 33 percent in 2020. 10 A recent Morgan Stanley poll found that 95 percent of millennials and 85 percent of all investors are now interested in sustainable investing strategies.11 With limited public market choices for investors with growing ESG demands and expectations, access to private company investing is critical.

While the industry is responding with new investment funds to access private companies, the fees are often high and the choices limited. Fundamental changes to technology and regulation are required to deliver quality private company access to retail investors. New technologies and products can allow efficient identification, qualification, and aggregation of retail investor participation into economically-aggregated Special Purpose Vehicle (SPV)s that can invest into higher ROI potential investments that only accredited and qualified investors can access today. These SPVs can be new limited partnership (LP) sources for venture capital funds and fund-of-funds, can support many new pre-seed and seed managers, and inspire new investment products, like private market Exchange Traded Fund (ETF)s, advisor-managed private portfolios, crowdfunding diversified portfolio investments, etc. Additionally, Robinhood’s and SoFi’s recently announced IPO retail participation structures are good moves to reconnect consumers to IPOs again (see the table in the accompanying infographic).

Today, the venture industry is flush with funding and enjoying strong exits, so there may be little interest in a new $67 trillion source of funds. However, let’s not fail to notice the upcoming inevitable changes, as we did while the late nineties’ raging bull markets riveted our attention, and the venture landscape was permanently altered. Despite much current success, there are many misalignments still in our industry, and retail investor participation can help fill those gaps uniquely to increase innovation and improve results. Harnessing the power of the democratization of the private markets can propel the ecosystem forward in ways not yet imagined. For example, retail participation in IPOs potentially can improve valuations and lower volatility, as we’ve seen the power of brand loyalty with consumer audiences investing in IPOs, delivering significantly higher valuations than equally monetized B2B IPOs.

There also is significant societal value in including retail investors in earlier-stage venture-backed deals again. Even before the COVID-19 pandemic, and certainly now much worse, the economic divide in our country is tearing us apart and has left the majority of the population suffering and fearful for the future.12 As human citizens, we have a duty to contribute to the betterment of everyone, which only increases prosperity for all, in an upward spiral. One additional suggestion for venture funds to consider is reserving two to five percent of LP commitments for a retail investor Limited Partner Special Purpose Vehicle (LP-SPV, which can be managed by an external SPV general partner to reduce administrative distractions). Similar to Warren Buffet’s and Bill and Melinda Gates’ Giving Pledge, this commitment to include retail investors in the most successful venture funds can help solve the pressing socio-economic issues created by the Wealth Divide. This can deliver ESG and branding value for the funds and partners, as well as great financial value for the portfolio companies, many of whom cater to consumer audiences who likely would benefit from accelerated early user growth, sales, and corporate branding from their many new investors and their networks.

In 2007, when the pain point was the disruption of the early IPOs model upon which the industry was structured, VC leaders called upon one of the co-authors to “fix the IPO Crisis”, and the first private markets platform was pioneered with strong industry support. Public and late-stage investors were connected to private venture-backed companies for a new source of funding that enabled new liquidity and exit solutions. 7 The private markets soon transcended the public market disruptions and helped grow wealth faster than ever – for the qualified and accredited investors with access to private market investing. The power of collaborative innovation cannot be denied, whether in the creation of the private markets or GameStop’s democratization of the public markets.

Footnotes

- World Inequality Report 2018, World Inequality Lab.

- Securities and Exchange Commission, Speech: PLI Investment Management Institute, Dahlia Blass, Director, Division of Investment Management, July 28, 2020.

- US Federal Reserve $67.3T US Retail Investment Assets – FEDERAL RESERVE FOOTNOTE

- NVCA Press Release April 29, 2009: Recommendations to Restore Liquidity in the Venture Capital Industry http://static1.squarespace.com/static/58f2d8b8579fb3f5948c2e83/58f2db9f5149bfb868e65d07/58f2dba35149bfb868e65f62/1492310947238/national-venture-capital-association-four-pillar-plan-april-2009.pdf?format=original

- NVCA 2020 Yearbook, https://nvca.org/wp-content/uploads/2020/03/NVCA-2020-Yearbook.pdf Page 4

- Waid, Robert. “Wilshire 5000: Myth and Misconceptions” November 2014

- https://www.cambridgeassociates.com/wp-content/uploads/2018/05/WEB-2017-Q4-USVC-Benchmark-Book.pdf

- Galipeau, Christian J. “S&P 500 Return Attribution” August 19, 2020

- Washington Post, “GameStop Stock Plunge Losers,” February 2, 2021 https://www.washingtonpost.com/technology/2021/02/02/gamestop-stock-plunge-losers/

- https://www.ussif.org/files/US%20SIF%20Trends%20Report%202020%20Executive%20Summary.pdf

- https://fortune.com/2020/12/27/shareholders-esg-investment-funds-capitalism

- https://www.dni.gov/files/ODNI/documents/assessments/GlobalTrends_2040.pdf

By Mona DeFrawi & Lincoln Ross, with gratitude for contributions by Radivision’s Advisory Board Members, Rena Silverman, and Peter Bass